From April 2020 HMRC is changing the rules related to the submissions of information and payment of Capital Gains Tax (CGT) due on the disposals of a UK residential property (other than a principle private residence). The tax due must be…

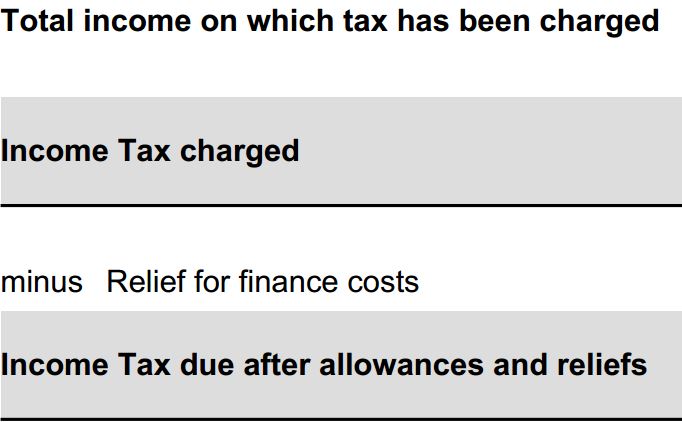

Restricting finance cost relief for individual landlords

Who is likely to be affected Individuals that receive rental income on residential property in the UK or elsewhere and incur finance costs (such as mortgage interest), excluding where the property meets all the criteria to be a furnished holiday letting….

The Rent a Room Scheme

The Rent a Room Scheme lets you earn up to a threshold of £7,500 per year tax-free from letting out furnished accommodation in your home. This is halved if you share the income with your partner or someone else. You can…

Let Property Campaign – Gives residential landlords the opportunity to bring their tax affairs up to date

You can report previously undisclosed taxes on rental income to HMRC under the Let Property Campaign if you’re an individual landlord renting out residential property. This includes you if you’re: renting out a single property renting out multiple properties a specialist…

HMRC: The Non-resident Landlord Scheme

The Non-Resident Landlords (NRL) Scheme is a scheme for taxing the UK rental income of non-resident landlords. The scheme requires UK letting agents to deduct basic rate tax from any rent they collect for non-resident landlords. If non-resident landlords don’t have…