Personal Self Assessment filing date has been extended and you will not be charged a late filing penalty if submitted by 28 February You can delay filing your return to avoid late filing penalty but you may still need to pay…

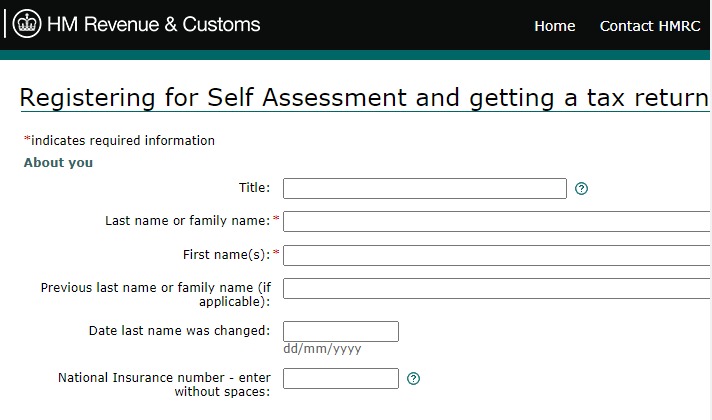

Registering for Self Assessment and getting a tax return

Use form SA1 if you need to register but you’re not self-employed. For example, if you: become a company director receive income from land and property in the UK have taxable foreign income of more than £300 a year receive yearly…